Steve Cohen Beat Insider Trading Charges. Now He Owns PSA

Steve Cohen’s SAC Capital pleaded guilty to insider trading in 2013.

$1.8 billion in fines.

Eight employees went to prison.

Over a decade of systematic fraud from 1999-2010.

Cohen? Zero criminal charges.

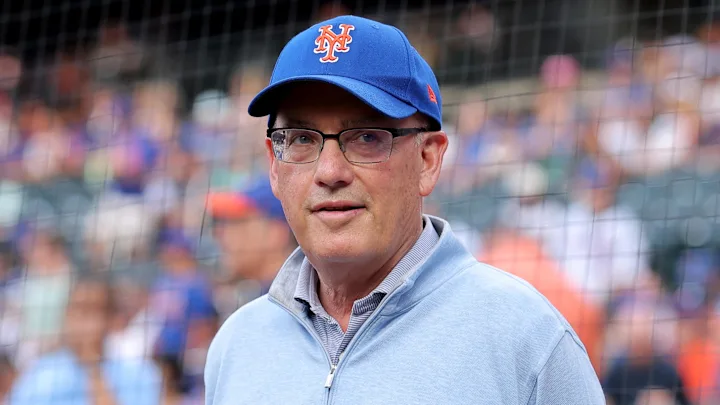

Steve Cohen

He received “highly suspicious information” and handed out massive bonuses to the traders running the schemes.

His punishment? A two-year timeout from managing outside money.

That’s it.

Some of his underlings went to jail.

The original SAC Capital shut down.

Cohen slapped a new name on it—Point72 Asset Management—and kept his cash.

That’s the important part.

The money.

After the rebrand, Point72 dropped $853 million to buy Collector’s Universe in 2020. That’s PSA’s parent company.

The guy who ran the biggest insider trading operation in hedge fund history now owns the company that grades your precious cards.

Recently, PSA’s was caught in a “grade swapping” scandal that’s raising eyebrows.

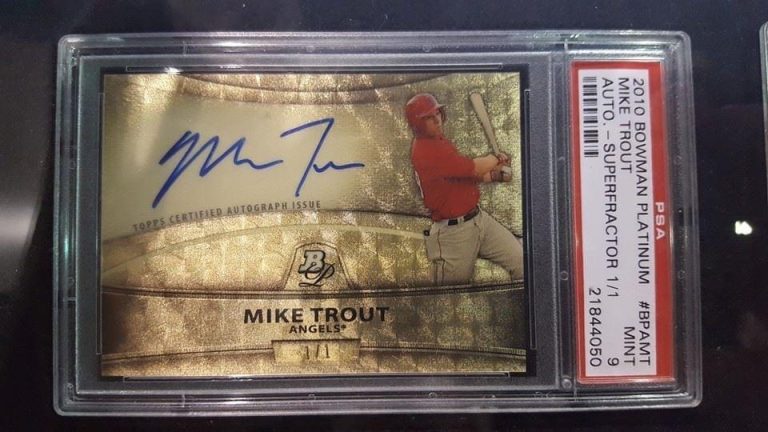

A collector submitted Pokemon cards. PSA graded them 9s.

The collector accepted third-party dealer offers through PSA’s website. Locked in. Done deal. PSA 9 prices.

Days later? The cards are suddenly PSA 10s.

PSA upgraded them AFTER the guy already agreed to sell at lower values.

Collector’s CEO Nat Turner’s explanation: “In this case, a few cards in an order received lower grades than the cards warranted initially, and were adjusted after being re-reviewed.”

Nat Turner

The grading system and offers system “don’t communicate.”

So collectors sell cards based at one grade, then PSA changes them after the fact.

Yikes.

Cohen made billions knowing things before everyone else did.

Now his company sets the grades. Runs the marketplace. AND changes grades after deals are struck.

All inside one closed system where PSA controls the information.

From Wall Street fraud to Pokemon cards. Quite a legacy.

And I guess Mets fans hate him right now too.

Grayson are you and Probstein releated?